Buying South Central Vermont Home With Good Bones

It doesn’t matter if you are buying your first South Central Vermont home or are a veteran home buyer, you will have list of ‘wants’ and ‘needs’ for your new South Central Vermont home. The ‘wants’ are things that would be nice to have such as a gas fireplace or granite counters. The ‘needs’ are things like, well a ‘bathroom’ or the number of bedrooms to suit your family. It is rare that you will get all your ‘wants’ and needs’ in the home you buy.

Location:

Location is the one thing you can’t change about a property. Location is about being in a desirable neighborhood and close to (but not necessarily next to) valued amenities or planned ones — employment opportunities, good schools, shopping, public transportation, major highways, parks and recreation, cultural activities, etc. A good location is also about not being on a high-traffic street, near noise, next to run-down properties, in a flood plain, etc.

Selling Your South Central Vermont Home In Changing Market

In today’s rapidly changing economy, many South Central Vermont home owners wonder or worry about selling their home for the best price, and terms in the shortest period of time.

Here are 9 helpful hints if you are considering selling your South Central Vermont home:

Be realistic, and price your home right by using market comparisons.

- Know your true bottom line for both price and time.

- As the market shifts, be prepared to evaluate your price.

- Advertising your property with yard signs, local MLS and newspapers.

- Get rid of the clutter! It makes your house appear smaller.

- Clean your walls, floors, baseboards, stove and refrigerator. Buyers will know your house is well cared for.

- Clean up outdoors! Remove tools, toys and be sure lawn and shrubs are neatly trimmed.

- Have the carpets cleaned to eliminate odors, smoke, and pet smells.

- Make minor repairs such as leaky faucets, sticky doors, etc.

- Do a walk-thru with your Realtor before listing your property.

Learn more about selling your South Central Vermont home by visiting ISellVermontRealEstate.com.

Tax Benefits of Owning a South Central Vermont Home

New tax code changes create benefits for owners of a South Central Vermont home. For years, many people have usually turned away from considering taking on the financial responsibilities of being a homeowner. Renters and prospective home owners are well aware of all the financial stress that comes with owning a home, which makes them hesitant to make the big step and commitment. What might not be known is that homeowners are receiving more tax benefits now than ever before. The Internal Revenue Services, known as the IRS, has made owning a South Central Vermont home a more favorable option in several ways.

Avoid These Mistakes When Selling Your South Central Vermont Home

Selling your South Central Vermont home should be a smooth profitable transaction. But it could end up being an unsuccessful, draining experience, especially if the appropriate precautions and preparations are not observed. A majority of the time, the chance for success lies within the hands of the hired real estate expert. In order to guarantee optimal results, the sellers must be willing to cooperate and consider the

Do not believe all real estate professionals are the same, choose wisely

The process of selling your home involves many tedious details and critical decisions. Real estate professionals are experts in handling these situations and offering knowledgeable guidance to sellers. It is crucial to research several professionals in order to find a suitable match with experience selling homes similar to yours. Real estate agents use different methods to sell their listings. Innovative professionals who promote listings with newer techniques to attract buyers are always more successful than professionals relying on traditional strategies. 24-7 advertising, excessive exposure and lead generation are important services agents offer to aid in selling your home. Hiring and utilizing the right real estate professional can significantly maximize the chances for a smooth, profitable transaction.

Auctions and Foreclosed South Central Vermont Homes

The number of people experiencing their South Central Vermont home entering foreclosure is steadily increasing. Also increasing, is the number of bargains just waiting for home buyers to make a move. In RealtyTrac’s April 2009 U.S. Foreclosure Market Report™ they found that default notices, auction sale notices and bank repossessions were reported on

342,038 properties during the month of April alone. The increasing numbers have contributed to the thirty two percent increase since last year’s April 2008 report. The report also showed one in every three hundred and seventy four homes received a foreclosure filing in April. These statistics prove foreclosure to be a growing threat to home owners. On the other hand, the foreclosure situation is benefiting people looking to purchase real estate in this buyer’s market.

The amount of foreclosure properties on the market opens the door to opportunity for buyers. One way for buyers to take advantage of the opportunity to purchase a foreclosed South Central Vermont home is through an auction. It is important for people, especially first timers, to become educated on how to buy a home at a foreclosure auction. The first place to start would be to look up general information about the process on the internet. Then, it might be a good idea to contact a real estate agent or real estate attorney for professional help and advising. Auctions can be organized in public places or held at local courthouses. It is best to avoid auctions held at courthouses because professional investors are common competitors and there is not much, if any, time to research the physical condition and financial background of the property being auctioned. Instead, find foreclosure auction notices in the local newspaper, online, or by contacting a city official for upcoming auction dates. It is important for buyers to research the property before deciding if they will bid on it. Prior to determining your bid gather some important information about to property such as, the estimated market value, outstanding loan balances, property liens, ownership history, title information, and calculate possible monthly expenses as the future homeowner. Once a little research is done on the property, enough knowledge will be available to determine the appropriate bid. Thoroughly looking farther in to the property can maximize your chances of getting a good bargain.

There are also other options for foreclosure buyers to consider. Today, most foreclosure properties have large or multiple mortgages. This takes away from the likelihood of getting a bargain at an auction because banks will ask for bids that are more than the actual value of the property. The first alternative is to buy the property before it goes to auction, which is called a pre-foreclosure. To do this check the city records to find foreclosure properties. Then, contact the owners by writing a letter of interest. Follow up with a phone call and hope they are willing to accept an offer. Another route is to wait to see if the property sells at the auction. If the property does not see it will be put on the market by the bank it is owned by. In this case you will be able to buy the house just like it was regular real estate. Another benefit to this option is the ability to conduct a home inspection and get a mortgage. Remember, when considering the purchase of a South Central Vermont home through an auction make sure plenty of research is done to maximize the potential of getting a good deal. Also keep in mind that if the odds are not looking good for the auction there are always other paths to take.

South Central Vermont Real Estate Sales Statistics – July 2009

A second quarter report of existing-home sales showed healthy gains from the first quarter, and price declines have increased affordability, according to the latest survey by the National Association of Realtors®.

Lawrence Yun, NAR chief economist, said the sales gain appears to be sustainable. “With low interest rates, lower home prices and a first-time buyer tax credit, we’ve been seeing healthy increases in home sales, which are a hopeful sign for the economy,” he said.

What is happening in our local South Central Vermont real estate market? Let’s take a look at statistics for the past six months for Rutland County, Windham County and Windsor County.

South Central Vermont Real Estate Sales Statistics

July 2009

Homes For Sale: 3289 (+12.6 percent)

Homes Sold: 134 (+143.6 percent)

Pending Sales: 126 (+85.3)

Average Sales Price: $214,000 (+30 percent)

Average Sq Ft Price: $126.2 (+24 percent)

Median Price: $180,000 (+35 percent)

Days On Market: 167 (-18 percent)

February 2009

Homes For Sale: 2922

Homes Sold: 55

Pending Sales: 68

Average Sales Price: $165,000

Average Sq Ft Price: $101.6

Median Price: $135,000

Days On Market: 142

With South Central Vermont real estate sales following the national upward trend, now is the time to buy. As you can see, an increase sales is followed by an increase in prices. Buy now for the best possible deal on South Central Vermont real estate.

Search all South Central Vermont real estate and homes for sale.

Are Lower South Central Vermont Real Estate Prices Worth The Wait?

Buyer’s often find themselves watching a property for a price reduction. Although getting the best deal possible when purchasing South Central Vermont real estate is important, it is not the only factor that determines monthly payments on a home. Rising interest rates nearly diminish the positive aspects of waiting for prices to drop.

Avoiding Buyer’s Remorse When Purchasing South Central VT Real Estate

As you walk through the house you envision the happy life you and your family would live and the future décor for this room and that room. You see houses that “require too much work,” “don’t have enough storage,” ones that are “too small” or maybe even one that is “do-able but not perfect.” Finally after weeks or even months of searching, you find “THE house.” Now you send in a promising offer and anxiously wait for feedback. You and seller come to an agreement and the offer is accepted. Once the papers are signed you can relax and enjoy the excitement, right?

Rutland VT Real Estate Appraisal Myths And Facts

On the other hand, a Comparative Market Analysis is used to determine a reasonable asking price based on the selling and listing prices of comparable real estate. This is conducted by the real estate agent listing the property. The sole purpose of a CMA is to help the real estate agent advise the sellers when trying to come up with an appropriate asking price. This is different from an appraisal because a Comparative Market Analysis helps determine the actual asking price, where as the appraisal reveals the property’s actual value. Appraisers usually use similar research on comparable properties as a factor in determining the property value.

Here are some myths and facts to help you lean more about the Appraisal of your Rutland VT real estate.

Rutland VT Foreclosure Trends – June 2009

There are 11 Rutland VT foreclosure homes for sale with 2 new foreclosures in June 2009, according to RealtyTrac.com. There were 21 new foreclosures in the state as a whole in June.

Rutland VT Foreclosure Activity and Home Price Index

Rutland VT foreclosures doubled in June compared to April and May with 2 homes being foreclosed. This is half the number of foreclosures from December 2008 when 4 homes foreclosed.

Rutland VT foreclosure activity is based on the total number of properties that receive foreclosure filings – default notice, foreclosure auction notice or repossession notice – each month. Home price appreciation is based on month-over-month percentage change of the Home Price Index. The Home Price Index is calculated from home sales records.

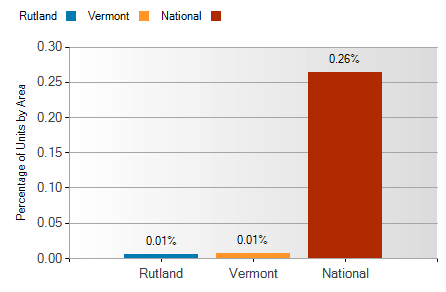

Rutland VT Foreclosure Geographical Comparison

Rutland VT foreclosure activity is lower 0.21% lower than national statistics and the same as Vermont statistics.

Are you or someone you know behind on your mortgage payments and facing a Rutland VT foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. Give me a call for a private consultation.

Learn more about Rutland VT real estate by visiting ISellVermontRealEstate.com.

Search all Rutland VT real estate and homes for sale.

Be realistic, and price your home right by using market comparisons.

Be realistic, and price your home right by using market comparisons.